System Cert Approvals

Requires XMPT PRO or XMPT ENTERPRISE plan

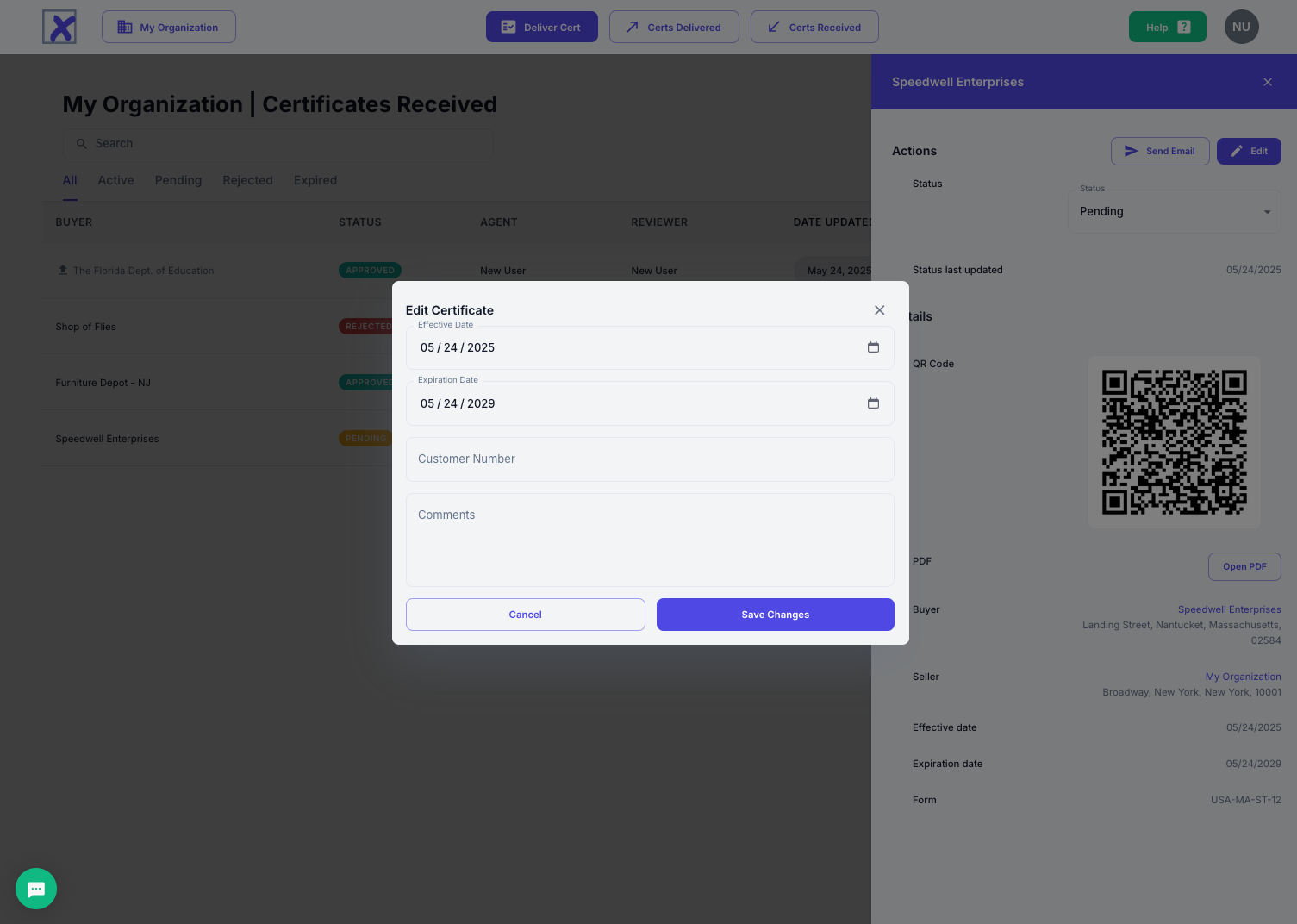

Once a cert has been received, it should be reviewed and either approved or rejected. The cert will remain in the pending status until it is changed.

Pending certs do not updated tax engines, and therefore no tax reduction will appear on future transactions until approved.

To change the status of the cert to either approved or rejected, select the appropriate status in the drop down box.

System generated cert data can not be edited, however recipients can adjust the effective and expiration dates, add a customer number (if appropriate), and make comments that will remain with the certificate record. To finalize the change, the reviewer must press the Save Changes button on the editing pop-up.

If there are errors on the form, it should be rejected and replaced by another form with corrected information.

Once approved, edits/changes can me made by changing the status back to "Pending", making the changes, and then re-approving the certificate.