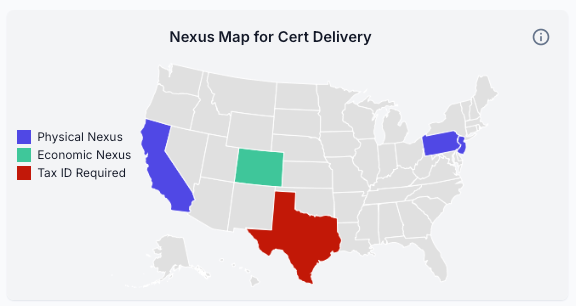

The Nexus Map

One of the most challenging elements of sales and use tax is nexus.

The Nexus Map for Cert Delivery visually displays the status of nexus across different states, helping organizations quickly identify which states require action when managing exemption certificates.

Red: States highlighted in red, like Texas, indicate that additional attention is needed. This indicator has been triggered by and external integration that indicates that there are employees in that jurisdiction, or that the transaction volumes processed have exceeded the allowable limits to not register. Until the state is colored purple or green, you will not be able to generate exemptions for those states.

Purple: States in purple, such as California and Pennsylvania, indicate that the organization has a physical nexus—meaning there is a registered physical address in XMPT. While a TIN should be added, it is not mandatory for certificate creation in these states. Physical nexus is managed using the Locations tab of XMPT.

Green: States in green, like Colorado, indicate that the organization has economic nexus. That means that a TIN is already present, but there is no physical address listed in XMPT. When a certificate is created for an economic nexus state, the system automatically uses the default address on the certificate. Economic nexus is managed using the Tax ID Numbers tab of XMPT.

Critical Note: Unless the state is colored green or purple, you will not be able to deliver an exemption using a form from that state. For example, the map above indicates that no exemption can be delivered for 45 states including Ohio, Florida, or Arizona.

When integrated with tax systems, XMPT identifies compliance requirements and coordinates necessary procedures across multiple platforms